What Are Opportunity Zones?

Opportunity Zones were enacted as part of the 2017 tax reform package (Tax Cuts and Jobs Act) to increase investment and improve economic recovery in distressed areas of the country. Opportunity Zones are set geographic areas within each state identified by Governors as economically distressed based on census data.

The Community benefit of the Opportunity Zone program is the incentive it provides for increased investment in business and property in distressed areas. The benefit to the Investor is the deferral or elimination of capital gains taxes in return for long term (10 years) investment in an Opportunity Zone Project.

An Opportunity Zone Fund is the investment vehicle required to realize these tax benefits. An Opportunity Zone Fund is comprised primarily of realized capital gains acquired through the sale of real estate or a business asset normally subject to capital gains tax. Funds are organized as a corporation or partnership and must hold at least 90 percent of its assets in an Opportunity Zone Project.

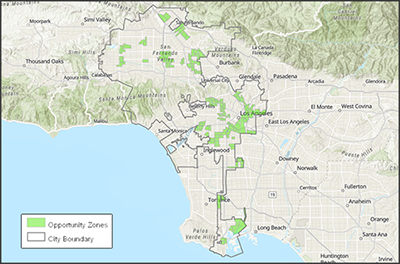

The City of Los Angeles has 193 Opportunity Zones approved in 13 Council Districts.

The Community benefit of the Opportunity Zone program is the incentive it provides for increased investment in business and property in distressed areas. The benefit to the Investor is the deferral or elimination of capital gains taxes in return for long term (10 years) investment in an Opportunity Zone Project.

An Opportunity Zone Fund is the investment vehicle required to realize these tax benefits. An Opportunity Zone Fund is comprised primarily of realized capital gains acquired through the sale of real estate or a business asset normally subject to capital gains tax. Funds are organized as a corporation or partnership and must hold at least 90 percent of its assets in an Opportunity Zone Project.

The City of Los Angeles has 193 Opportunity Zones approved in 13 Council Districts.

Additional Resources

- California Opportunity Zone Portal

- IRS.gov

- Treasury.gov

- CDFIFund.gov - Opportunity Zones Information

- IRS.gov - Opportunity Zones FAQs

- IRS Issues Guidance on Opportunity Zones to Spur Private Investment In Distressed Communities

(8 February 2018, US Treasury Press Release) - Investing in Qualified Opportunity Funds

29 October 2018, Proposed Rule by the IRS